Connecting for Results (CFR) and the Canadian Printing Industries Association (CPIA) conducted the 2024 Industry Insights Survey for Canada over the summer. This is the second national survey conducted by CFR and the first offered in partnership with the CPIA.

With so many changes and dynamic challenges facing printers in recent years, the goal is to provide a better understanding of the current state of print in Canada. There is current industry information available from some of the leading US and international organizations, however how relevant is this for the Canadian markets? As this is an election year, historically this creates a material boost for the US printing industry.

Participant Profile

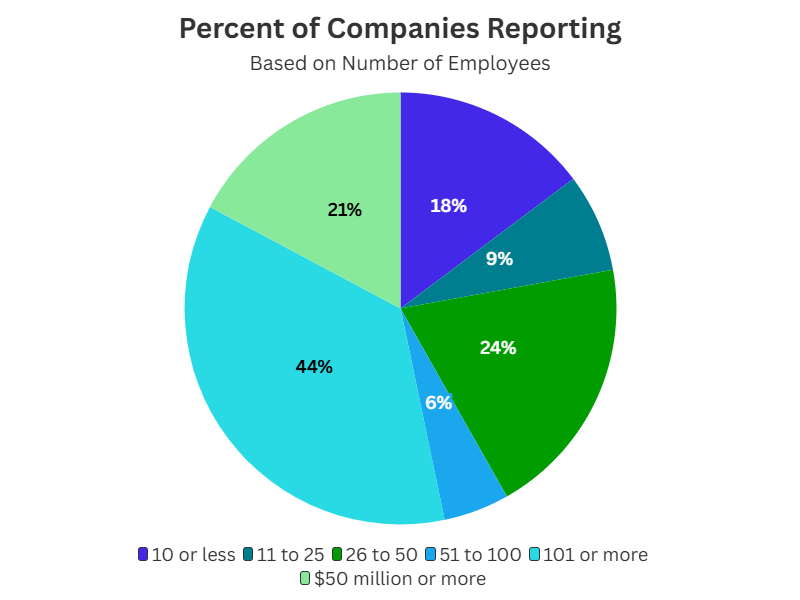

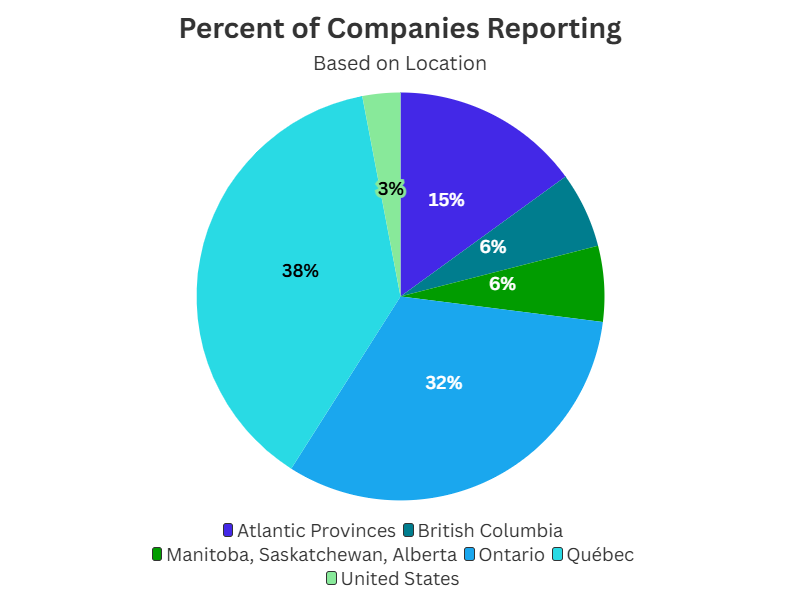

The responses were well balanced from all aspects of company metrics, including size, industry segment, and location.

Industry Conditions

Over the last 2 quarters, compared to the same period previous year, the companies reporting a sales increase (41%) was balanced by the companies reporting a sales decrease (41%). Therefore, it appears that printers are just ‘trading work’.

Margins remained the same for 50%, however decreased for 29% of printers, and increased for just 21%. It appears that some, but not all, of the increased sales is coming at the expense of margins.

That being said, 41% also indicated that they were able to raise prices greater than inflation, while 12% were not. This may indicate that there is less work to go around, however production questions will confirm.

For the volume of work, those reporting an increase (32%) was offset by those reporting a decrease (35%). The gap of 10% from those reporting revenue increase appears to confirm that there is less work to go around, and revenue increases may have been in part due to higher prices.

Another factor supporting growth is the number of customers served, 47% reported an increase to the number of customers served, while only 12% reported a decrease. Also of interest, 56% increased the products or services added, indicating more diversification.

On the employment front, the majority did not need to hire more staff (53%), however there were quite a few (38%) that had the need to hire staff. The need to hire staff will continue into the second half of 2024 for 32% of the companies.

General conditions

The majority (53%) indicated general conditions were similar while a sizable percentage (29%) indicated that general business conditions were worse over the last 2 quarters. It’s positive to see that a sizable number (32%) believe that conditions will improve over the next 2 quarters and 53% believe conditions will remain the same.

Pressure on Sales Efforts

Looking to the future, the majority (62%) are expecting an increase for both revenue and volume of work for the 2nd half of 2024. This includes 62% who expect to be serving more customers.

Labour Challenges Continue . . .

The need and challenge to hire staff was either a moderate, or severe challenge for 66% of the respondents, with the following positions being the hardest to fill:

- Skilled production labour 56%

- Sales staff 47%

- Operations staff 24%

Companies have done the following to help overcome these issues.

- Increase starting salaries 74%

- Offer flex time / reduced hrs 56%

- And to keep the current staff satisfied 53% have increased compensation greater than the cost of living.

Investments in Technology and People

Companies have recently invested in new print / digital technology (53%) and a similar level of investment appears to continue for the next 12 months (47%). The following represent the other priority investments:

- Workflow software 35%

- eCommerce technology 32%

- Bindery technology 26%

The priority is similar for recent investments and planned investments for the next 12 months.

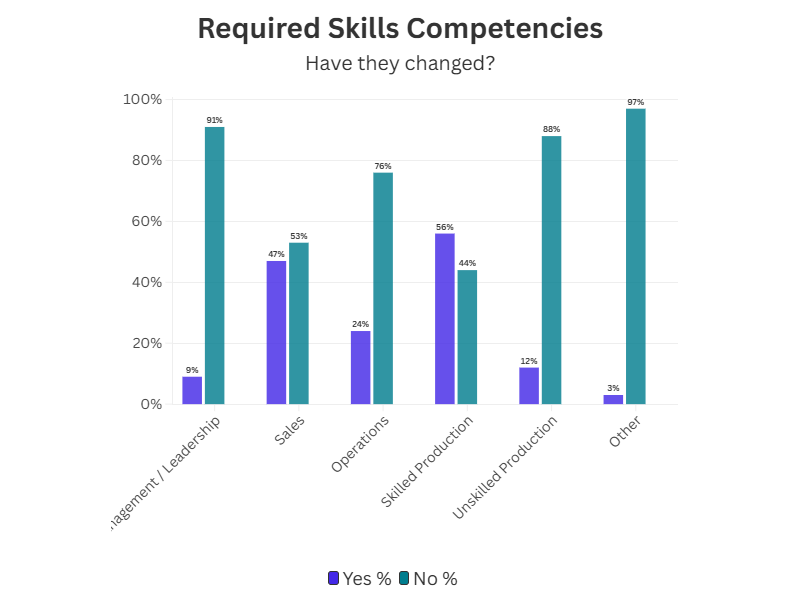

Another interesting finding was the inquire where job skills have changed. It turns out that skill production skills were reported as the highest change at 56% of the respondents.

- Sales 47%

- Operations 24%

- Skilled Production 56%

Artificial Intelligence (AI) is Starting

While there is lot of media coverage about AI, members of the graphic arts community do not appear to be adopting it in great numbers. Here are the top applications as reported:

- Market research / content creation 38%

- Graphic design / layout / creative 29%

- Sales – proposal development 26%

- Pre-press automation 21%

- Production analytics 12%

- Service and training 12%

- Estimating 12%

- Job intake – onboarding 9%

- Scheduling and Planning 9%

What about the future?

The following are reported to be the greatest concerns for the next 12 months. It’s no surprise that maintaining profitable sales are the major concerns, and rising costs are a major contributor to the reason for the concern.

- Increasing sales 50%

- Maintaining profitability 41%

- Rising transportation costs 38%

- Losing to print alternatives 32%

- Rising labor costs 26%

- Rising energy costs 24%

- Rising substrate costs 24%

- Working capital balance 24%

- Labor shortages 18%

- Rising ink/toner costs 18%

- Maintaining productivity 9%

- Material Shortage 9%

Have your say . . .

Here are comments from survey participants:

As the demand for print continues to decline and printers keep dropping their prices, we will see significant change in our industry’s landscape (as it pertains to the number of companies serving the market) – Covid [Government support] provided a lot of artificial respiration for those printing companies that were in trouble………

Bankruptcies and/or plant closures are not a good look for our industry and will impact suppliers and other stakeholders. We are hopeful that everyone will be financially responsible and at the same time concerned that the cost of the market correction will impact the remaining businesses negatively.

As the industry changes, we need to constantly look for new products to produce. This isn’t very hard as I still feel there are many things our business can make; however, they require new equipment and different customers. This means radical investment in new equipment, and a significant amount more work for our sales team. All of which means higher costs and lower margins. •

We are investing in finding environmentally friendly substrates – they are always move expensive and clients not willing to pay more • Our direct mail division is a going concern as clients move budgets to digital. • Finding skilled labour – press operators in particular is a challenge. • Succession planning is a priority

Global conflict

US Elections

Our industry is shrinking, whether from companies getting acquired or closing entirely, or from the pool of applicants shrinking. Programs like GCOM and PELT can only go so far. Our industry needs to do more to gain exposure in the work force as a desirable career, and we need to do a serious deep dive into what we are paying our talent. I happen to work for a company who pays well, but we are one of only a few. Since the recession, print companies and supplier companies (especially small and medium sized) have tightened their wallets due to fear of failure financially and it is not helping our industry. Companies that come in and undercut all the prices do not help our industry. We cannot lead from a place of fear and always go for the cheapest option to win business, we must work smarter, provide better quality, service, turnaround, and we should have regulated price points to keep the market fair. This would push companies to turn to innovation and improving their offerings rather than just lowering their prices until they can’t afford to do business anymore.

All factors play a part in making the business climate less desirable. Rising interest rates make borrowing more risky. Inflation makes life tough for our employees and puts a lot of pressure on us to keep their wages competitive with other industries where hourly rates are higher. Inflationary pressures cause other businesses to pull back advertising dollars because they have less discretionary spending. Carbon taxes are robbing profits from printing companies and every other business as well which means less money to spend on investment or advertising. Machine costs are crazy high today. Parts are getting harder to find and prices are sometimes exorbitant. Our clients are producing same jobs with less quantity per job. Means we need to find more work to sustain our current capacity. With less work everywhere this makes things challenging. Rising transportation costs make it more difficult to compete outside of Canada and even further across Canada.