The current state of M+A activity in Canada

Companies need to evolve and grow in order to thrive. Maintaining status quo may provide regular income, but since most business relationships are not static, new customers are needed, new services should be offered, equipment needs to be replaced, and re-investment is required. Organic growth is good, but faces constant challenges, especially with our current substrate supply issues.

Merger or acquisition are options, but also face many challenges and risks. What is the current state of M+A activity in Canada? Connecting for Results has conducted a study of publicly announced deals involving Canadian companies over the past two years and can share some interesting insights.

We are aware that activity for acquisitions virtually ground to a halt in 2020 due to the pandemic. As expected, there was increased activity in 2021. However, the level of activity increased at a significant pace in 2022. In the first five months, more deals were announced than all of 2021.

Why has activity picked up so much? To a degree there was pent-up demand, with some of the deals-in-progress resuming, but most of those were completed in 2021.

We have heard from several sellers the pandemic has taken a lot out of them, and they are now dealing with the new challenges of paper shortages and labour challenges.

Since business has picked up for many, and valuations are returning to pre-pandemic levels, with positive trends, many view now is the right time to sell. The new, and significant demands placed on business owners has given them the incentive to consider their work-life balance. Selling a business is not a simple or quick activity, and sellers are often expected to remain engaged for one or more years to support transition activity, if they wish to obtain the highest value for their company.

What’s selling?

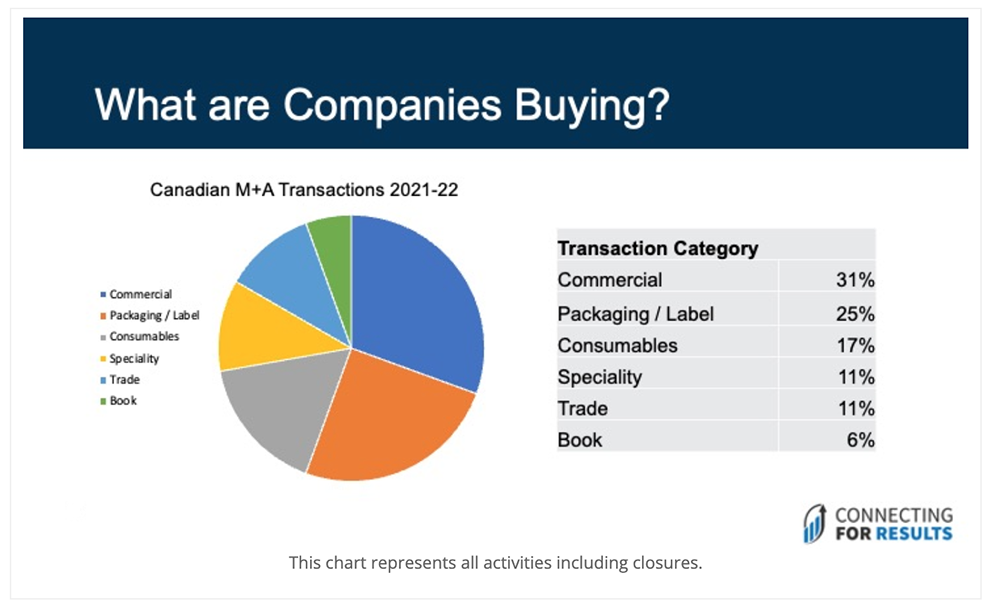

With all this activity, what are companies buying? While the spread of purchases appears to be balanced across the industry segments, commercial printers and packaging companies represent the majority of deals. These segments also represent the majority of the companies and print volume in Canada (70 to 75 per cent). There were several closures, especially in the trade segment and cold-set web plants. Some of the commercial transactions were classified as mergers.

Who is buying?

There has been a lot of discussion about private equity (PE) buyers. While there is PE activity in Canada, we have also added ‘professional buyers’ to this category. This would include large companies/consolidators who employ professionals to review the market, assess the opportunities and put deals together. In all cases, the common element, is that the deal needs to make business sense. The synergies come from different aspects including cost reduction, business growth, and additional capabilities. New reasons to purchase a company include access to paper and labour, which are issues that are projected to remain a problem for at least a year or more.

Many deals that are based on business closures and asset sales are not publicly announced, and there are buyers interested in acquiring ‘destressed’ companies. This has always been the case, especially during times of economic challenges. Generally, very few buyers want to buy unprofitable companies as an operating entity. Most prefer to wait for the company to close, then they may acquire some of the assets, and try to secure their customers/sales. The previous owners are then left to deal with the creditors, leases, contracts, staff, and severances. This activity still requires professional support to make sure that staff, customers, creditors, suppliers, and government agencies are dealt with fairly to limit personal liability. Whatever your perspective and business goals, we wish you success!

By Bob Dale and Gordon Griffiths

This article originally appeared in the July/August 2022 issue of PrintAction.